The AI chip designer is tipped to be a homegrown Nvidia now that Beijing wants less reliance on foreign tech and fewer headaches from US export bans.

Founded in 2020 by former Nvidia executive Zhang Jianzhong, the outfit soared more than fivefold on its market debut on Friday after raising the equivalent of more than €920 million in a scorching IPO. Revenue tripled last year, although the company still burned through cash.

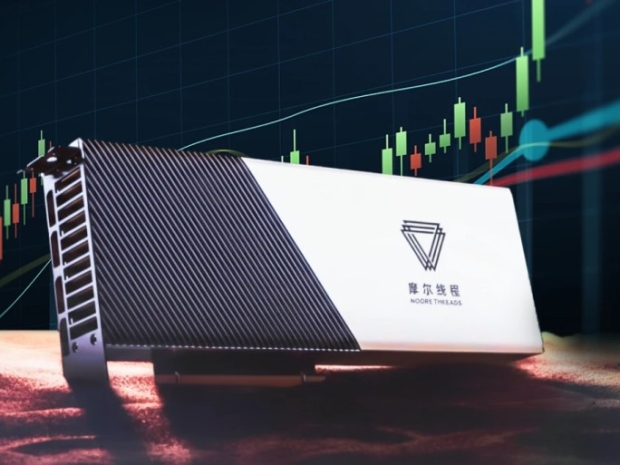

Moore Threads builds GPUs for AI training just like Zhang’s old shop and is the first of China’s so-called four little dragons to float on the stock market.

Billions have poured into China’s tech scene since startup DeepSeek lobbed out a large language model to rival ChatGPT at a fraction of the cost, sending Alibaba and Tencent scrambling to outdo each other with ever beefier models.

In October 2023, the Biden administration added Moore Threads to the Commerce Department’s entity list, citing national security concerns, a move that made it harder for the firm to source advanced kit.

Company founder Zhang told a Chinese state-owned newspaper that “computing power is state power” and insisted AI is not in a bubble, provided developers avoid bottlenecks and models keep advancing. His remark echoed the bullish mood gripping China’s AI boosters, although analysts still reckon domestic chips and models trail foreign rivals in the trickier bits of performance.

Policymaker backing and investor excitement keep the dragon fire burning. It is a sharp contrast with the US, where the cocaine nose jobs of Wall Street are twitchy about sky-high valuations and monstrous spending commitments that hint at an AI bubble.

Even with Friday’s rocket ride, Moore Threads is still tiny beside Nvidia and the other Western giants. The Beijing outfit finished with a market cap of 282.3 billion yuan (about €36.5 billion), while Nvidia sits near $4.5 trillion.

The company plans to funnel its fresh cash into AI chip research and development, and working capital. It used a recently reopened route for unprofitable tech firms to list on Shanghai’s STAR Market, the Nasdaq-style venue created in 2019 to help ambitious tech outfits raise proper growth funds.

Shares closed at 600.5 yuan, up 425 per cent from the IPO price. Retail investors went berserk, with orders for their slice of the offering outstripping available shares by about 2,750 times.