The quarterly earnings report from Nvidia has become a measure for investors to assess the strength of the recent AI boom that has captivated markets.

The robust results indicate that demand for Nvidia's AI chips continues to be strong. CEO Jensen Huang mentioned that the company would see revenue from its next-generation AI chip, Blackwell, later this year.

The stock increased by seven per cent in extended trading. Nvidia announced a stock split of 10 to 1. Following the after-market movement, the shares are set to achieve a new high on Thursday.

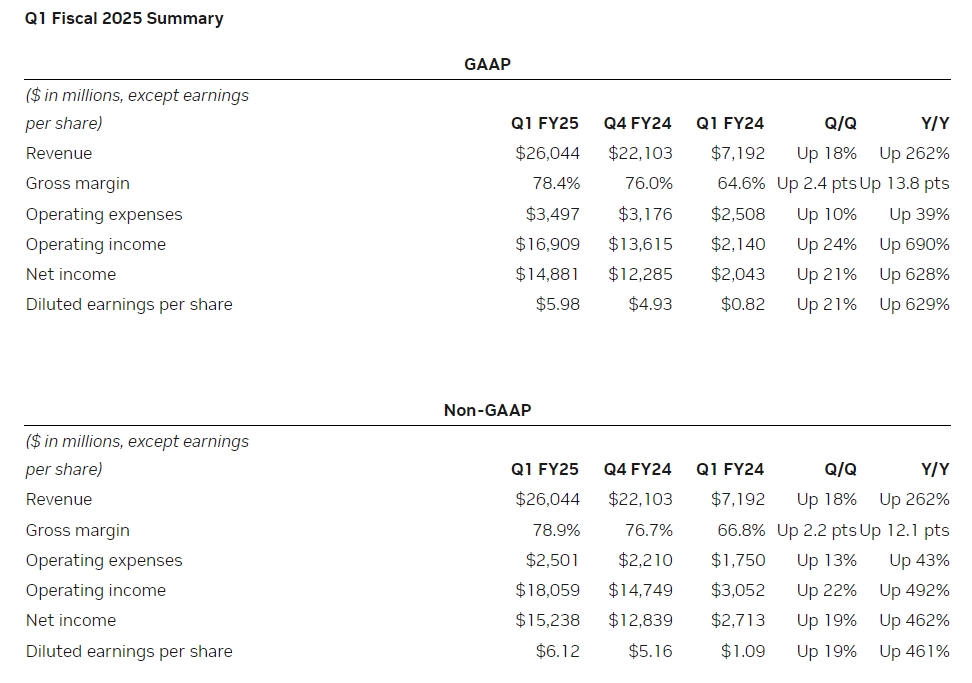

Earnings Per Share: $6.12 adjusted (€7.25) vs. $5.59 adjusted (€6.63), according to LSEG consensus estimates.

Revenue: $26.04 billion (€30.89 billion) vs. $24.65 billion (€29.23 billion) expected by LSEG

Nvidia anticipates sales of $28 billion (approximately €33.20 billion) in the current quarter. Wall Street predicted earnings per share of $5.95 (approximately €7.05) on sales of $26.61 billion (€31.55 billion).

The chipmaker reported a net income for the quarter ending April 28 of $14.88 billion (€17.64 billion), or $5.98 per share (€7.09), compared with $2.04 billion (€2.42 billion), or 82 pence, in the same period last year.

Over the past year, Nvidia's sales have soared as companies like Google, Microsoft, Meta, Amazon, and OpenAI have purchased billions of pounds worth of Nvidia’s graphics processing units, which are sophisticated and costly chips necessary for developing and deploying artificial intelligence applications.

The company's most significant business is its data centre sales, including its AI chips and many other components necessary to operate large AI servers.

Nvidia reported that its data centre category increased by 427 per cent from the previous year's quarter to $22.6 billion (€26.79 billion) in revenue. Nvidia's finance chief Colette Kress stated that this was due to the shipments of the company's Hopper graphics processors, which feature the company's H100 GPU.

"A major highlight this quarter was Meta's announcement of Lama 3, their latest large language model which utilised 24,000 H100 GPUs," Kress mentioned during a call with analysts. She added that large cloud providers account for about "mid-40 per cent" of Nvidia's data centre revenue.

As the company reports a tripling or more of its business, Huang stated that its next-generation Blackwell AI GPU would contribute to further growth.

"We will see a lot of Blackwell revenue this year," the CEO commented during a call with analysts, adding that the new chip would be in data centres by the fourth quarter.

Nvidia emphasised strong sales of its networking components, which are becoming increasingly vital as companies construct clusters of tens of thousands of chips that need to be interconnected.

Nvidia reported that it had $3.2 billion (€3.79 billion) in networking revenue, mainly its InfiniBand products, which was over three times higher than sales in the same period the previous year.

Before becoming the leading supplier to large companies building AI, Nvidia was primarily known as a firm producing hardware for 3D gaming. Gaming revenue increased by 18 per cent during the quarter to $2.65 billion (€3.14 billion), which Nvidia attributed to robust demand.

The company markets chips for vehicles and chips for advanced graphics workstations, which remain much smaller than its data centre business. It reported $427 million (€506 million) in professional visualisation sales, and $329 million (€390 million) in automotive sales.

Nvidia stated it repurchased $7.7 billion (€9.13 billion) worth of its shares and paid $98 million (€116 million) in dividends during the quarter. Nvidia also mentioned that it is increasing its quarterly cash dividend from four cents per share to 10 cents on a pre-split basis. After the split, the dividend will be one cent per share.