The full report includes revenue of $1.8 billion and some change, which is a nine percent jump compared to the same quarter last year and an 18 percent jump compared to the last quarter. The high jump comes mostly from the Computing and Graphics segment which offsetted lower revenue from the Enterprise, Embedded and Semi-Custom segment of the company. This shows that AMD is definitely moving those Ryzen CPUs and probably some graphics cards, but did say that EPYC processor sales are going up, partially offsetting low semi-custom business.

“Our first full quarter of 7nm Ryzen, Radeon and EPYC processor sales drove our highest quarterly revenue since 2005, our highest quarterly gross margin since 2012 and a significant increase in net income year-over-year,” said Dr. Lisa Su, AMD president and CEO. “I am extremely pleased with our progress as we have the strongest product portfolio in our history, significant customer momentum and a leadership product roadmap for 2020 and beyond.”

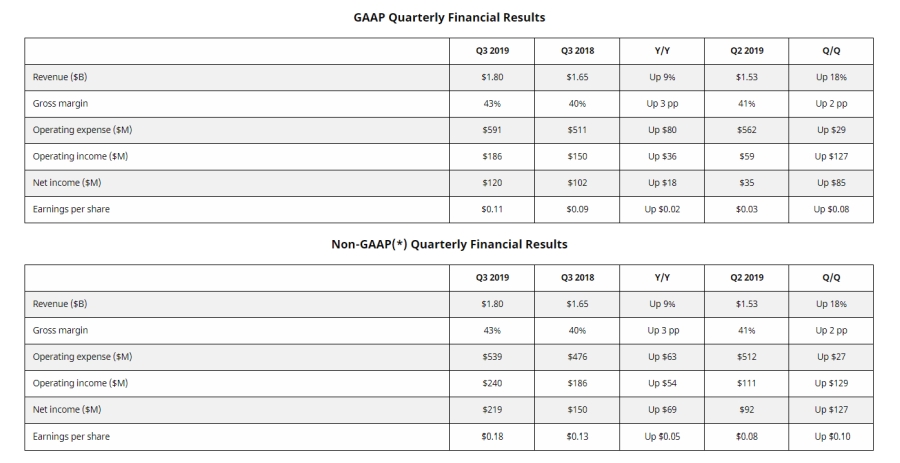

The gross margin in Q3 2019 ended up at 43 percent, showing a steady rise of three percent compared to the last year and two percent compared to the last quarter. The operating income was at $186 million, with a net income of $120 million, and earning per share were up to $0.11.

The biggest winner for the company is its Computing and Graphics segment, reporting a revenue of $1.276 billion, and a big boost from $940 million last quarter and $938 in the same quarter last year. The operating income for that segment was $179 million. AMD states that most of these come from Ryzen client processor sales, both desktop and mobile.

The Enterprise, Embedded and Semi-Custom segment did not do that well this quarter, with revenue of $525 million, down by 27 percent compared to the last year and 11 percent compared to the last quarter. AMD did note that EPYC sales are rising but semi-custom revenue is down. Operating income was at $61 million, down from $86 million in the same quarter last year and $89 million in the last quarter.

Operating loss was set at $54 million, up from $36 million in the last year and $52 million in the previous quarter.

AMD did a lot in the Q3 2019, launching 2nd gen EPYC CPUs, which got into Google's systems, Twitter, IBM Cloud, Nokia, Cray's Shasta supercomputer, and others, as well as enterprise, HPC and cloud platforms from Dell, HPE, Lenovo and others.

HP and Lenovo launched a lot of systems with AMD's Ryzen Pro 3000 series CPUs, or other AMD new CPUs, and launched the new RDNA-based RX 5500 and RX 5500M series graphics cards, and more.

For the Q4 2019, AMD expects an even higher revenue of $2.1 billion (+/- $50 million), which is an increase of 17 percent compared to the current quarter and 48 percent compared to the same quarter last year. This should be driven by even higher sales of Ryzen CPUs, as well as EPYC CPUs, and Radeon graphics cards.

AMD has been doing well in the last few quarters and all the hard work is paying off, as the company has a solid roadmap so hopefully, it can keep up the good work as Intel struggles with 10nm manufacturing process and keeping up with the demand.